Fiscal support for offshore wind projects in the UK is set to rise at the expense of onshore wind and solar photovoltaic (PV) projects after the government published strike prices (guaranteed payments) for renewable energy.

The rates for onshore wind energy and solar PV projects will be lower than the draft rates published earlier this year, while the rates for offshore wind energy will be higher. The government said that the rates reflected the fact that the costs of offshore wind energy would not fall as quickly as had been anticipated, while the cost of capital for most other renewable energy technologies would fall.

It believes that the strike prices - a major part of its upcoming energy market reform plan - will attract additional investments of around £40 billion in the renewable energy sector to 2020 and keep the UK on track to meet its objectives on renewable energy, decarbonisation, security of supply and controlling energy costs.

The announcement comes just weeks after the European Commission published new guidelines on state support in the energy sector and the announcement by the UK government that it would provide a guaranteed price for nuclear energy from the proposed new Hinkley Point reactor for 35 years.

Yesterday the government also said that it would provide Horizon Nuclear Power with a guarantee to help finance the proposed Wylfa Newydd reactor in Wales.

The government says that investment in new generating capacity is essential in order to keep the lights on in the UK as 10-12 per cent of existing capacity closes over the next decade.

"This package will deliver record levels of investment in green energy by 2020," said Energy and Climate Change Secretary Edward Davey. "Our reforms are succeeding in attracting investors from around the world so Britain can replace our ageing power station and keep the lights on."

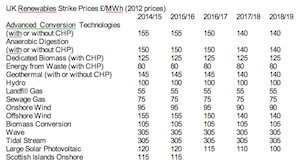

The strike prices published show that in 2014/15, onshore wind project will receive £95/MWh, large-scale solar PV £120/MWh and offshore wind £155/MWh. Geothermal project will receive £145/MWh while wave and tidal stream projects will receive £305/MWh.

Support for most technologies falls slightly by 2017/18 to reflect the expected fall in costs of renewable energy.

By comparison, the strike price agreed by EDF and the government for energy from the new Hinkley Point plant in Somerset is fixed at £92.50/MWh.

The draft strike prices published earlier this year indicated that onshore wind and solar PV projects would receive £5/MWh more.

"At first glance, it would be easy to say 'this is going to affect onshore wind and solar massively'," said David Ferris of legal firm Osborne Clarke. "But the devil's in the detail, and the information being released shows the changes are more in line with the accepted and continuing movement towards tapering off of subsidy levels as technology matures and costs reduce, reflecting the strength and maturity of the UK onshore renewables industry."

"If we're not careful, we'll lose sight of the really important detail here: this only affects future onshore solar and wind projects that are over 5 MW and are not yet accredited. In short, there's lots of great renewables projects that this simply doesn't affect."

The European Commission said in its recent guidance on state support for energy that while subsidy schemes should remain stable, they should also be reviewed and adjusted over time to reflect falling costs.

It also indicated in December that it would examine the UK's nuclear guarantee scheme because it was concerned that it contravened state aid rules.

Greenpeace said in a statement that the "cuts to onshore wind and solar support schemes show how quickly the cost of clean energy technologies are falling" and that it was right for the government to "put emphasis onto helping drive down the cost of offshore wind so that the UK can reap the rewards of new turbine factories and thousands of new jobs".

Trade body RenewableUK said that the government's support for offshore wind would help to "attract big wind turbine manufacturers to the UK". It called the drop in support for onshore wind "unwelcome" because smaller, community-led wind schemes would be cancelled.

The Financial Times reported that Renewable Energy Systems said it would cancel some onshore wind projects, especially marginal projects in less windy areas.

The strike prices are part of the government's contract for differences (CfD) scheme, which will pay generators a top-up when wholesale prices fall below the strike price, thereby providing generators with predictable revenue streams and reducing investor risk.

The CfD scheme will replace the existing renewable obligation certificate (ROC) scheme, whereby renewable generators receive tradeable green certificates for the renewable energy they generate. Onshore wind projects currently receive 0.9 ROCs/MWh and offshore wind 2 ROCs/MWh, in addition to the wholesale electricity price, which currently stands at around £55/MWh.

ROCs have no fixed price but are traded. The most recent auction raised an average price of around £43/ROC.

There are currently over 20 GW of renewable energy capacity operating in the UK and the government says that this could double by 2020. The pipeline for consented offshore and onshore wind energy currently stands at around 11 GW.

Offshore wind energy capacity stands at around 6 GW, and a further 36 GW is planned over the next 15 years.

Table Notes

- The strike prices in Table 1 show the strike price for projects commissioning in the year stated in the column.

- These prices are in all cases maximum strike prices. In the case that constrained allocation applies earlier, the actual strike price will be the outcome of the constrained allocation process if that is a lower value.

- While strike prices have been set out for 14/15 in order to ensure comparability, the EMR consultation on proposals for implementation discussed a start date for CfD payments of April 2015.

- Tidal range projects, which include both tidal lagoon and tidal barrage technologies, do not have a published strike price. Instead, given the lack of cost data available DECC will consider how best to price CfDs and the appropriate length of contracts for these projects on a case by case basis.

- The strike prices for Tidal Stream and Wave are intended for the first 30 MW capacity of any project.

Source: DECC