combined cycle

Fast cycling towards bigger profits

1 June 2007To maximise profits in today’s power markets combined cycle plants must be as flexible as possible and capable of fast start-up. With the right package of technologies, very fast start-up times can be achieved and have been demonstrated in the field at operating plants.

Most combined cycle plants were initially designed for baseload operation, with low fuel prices in the 1990s resulting in low electricity costs. Today, however, many already existing combined cycle plants have shifted to intermediate load and new plants are specified for cycling load regimes because of the current high gas prices and the addition of wind capacity dictating a need for flexible back-up power supply. Therefore features providing high operational flexibility, such as short start-up and shut-down times, are highly valued today by power plant owners.

Market drivers

Additional drivers increasing the emphasis on flexibility are the volatile, deregulated, power markets and related risks, such as fluctuating fuel and electricity prices. In addition, a flexible plant opens up new business opportunities including getting involved in hourly and seasonal market arbitrage, participation in ancillary energy markets and peak shaving. Therefore, plants need to have short start-up times and good cycling capabilities, while at the same time achieving the highest possible efficiencies.

In the highly competitive liberalised markets of today many plants do not have a power purchase agreement that guarantees long term and stable revenues. They are more likely to operate as market driven merchant plants in direct competition with other power plants positioned most favourably in the dispatch ranking. Energy traders have various markets offering a variety of different opportunities for placing the power output. Examples are bilateral OTC contracts, power exchanges or markets for ancillary services. Each of these markets itself can be accessed with a variety of products. Within this context a share of the power output can be placed with a long term contract, providing planning security over longer periods, but with lower margins, while another part of the power output can be sold under short term agreements, on the day or even an hour prior, offering higher margins linked to higher risks.

As well as the idea of participating in the market by dividing up the power output, provision of ancillary services provides other ways of achieving higher revenues in liberalised energy markets. For instance, for spinning reserve an allowance is paid simply for the capability to provide power on request. In the event of being dispatched, the power must be provided within minutes and an additional utilisation fee is paid. The plant’s capability for participation is the chief criterion to qualify for this market, and a value can be attached in terms of the extra earnings it can bring.

What is required from power plants?

Siemens’ reference power plant (RPP) development activities are focused on life-cycle-cost optimisation by identifying and understanding the most important drivers for maximising customer value. The focus of these activities has changed over the years according to the evolving market requirements. In the 1990s, the reference power plants were designed for baseload operation with a small number of starts per year. At that time the start-up time for a 400 MW single shaft plant after an overnight shut-down (of about eight hours) was 90 minutes.

In response to the altered market requirements, we developed several features that were incorporated into the reference power plants. These included a fast start-up concept reducing the start-up time after overnight shutdown for a single-shaft plant by more than 50%.

Looking at the distribution of the dispatch ranking for different power plants in the USA, for example, it can be seen (Figure 1) that the combined cycle plants are relatively close in terms of production costs. In the current market situation, they are in the steep part of the dispatch curve and are mostly in the mid-merit rank. In this area especially a small change in production cost can have a huge impact on the dispatch rate. If a change in plant flexibility reduces the production cost by 6 to 8%, the dispatch rate can increase from 10 to 70%, potentially offering a significant improvement in plant economics, and strengthening the economic case for retrofitting existing units.

Figure 2 shows another view of what is required from the various power plant types. This is for the case of Germany, with its increasing wind load. Starting from the bottom of the curve, the renewables replace other baseload units due to the feed-in obligation.

With the rising share of wind, there is the risk in a low total load situation that, without sufficient flexible back up power from combined cycle and gas turbines, the whole system will be at risk of not sufficiently maintaining reliability of supply in the case of a wind shortage.

How to improve cycling capability

Some of our F-class units already start-up approximately 300 times per year on a daily cycling routine. An improvement in the start-up time and cycling capability will put those plants into the best position to comply with the complex market requirements and to maintain a system reliability.

The cycling capability improvements encompass the entire plant, not just individual components. A selection of measures can be seen in Figure 3.

High performance components play a key role in the plant optimisation, however individually they do not do the trick. Only by incorporating know-how from all the different areas and optimising the interaction between the main components, such as gas turbine/steam turbine/generator and all the major balance of plant equipment (HRSG, pumps, deaeration system etc) and the control system, was it possible to significantly improve the cycling behaviour of the plant.

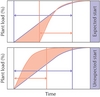

A faster plant start-up will provide significant benefits whether the start is expected or unexpected (see Figure 4). What do we consider to be an expected or an unexpected start?

An expected start will be the normal start where you know that you have to deliver a certain amount of power at a certain time. The plant is planned to be on-line at times when the revenues are higher than the marginal cost of generation. Generally the revenues are below the marginal cost before that time. With a faster start-up less power will be produced during the unfavourable revenue time than with a slower start-up and will be at full power at the same, favourable, time as with the slower start-up.

In addition that power will be produced at a higher average efficiency as the steeper start-up curve gets you through the low efficiency area faster. The efficiency gain can be translated into saved fuel. Per start this will be around h2700 with an assumed fuel price of h4.9/GJ. For a cycling plant with 200 starts per year this can sum up easily to more than half a million h per year direct savings. Additional savings can come from reduced CO2 emissions of about 30t for each fast start-up.

An unexpected start could be triggered by a call from dispatch that additional power is needed or when an additional short-term market opportunity arises. It is here that the power is needed as fast as possible. Each generated megawatt will have revenues above the marginal cost. With the faster start-up you will generate more power in the same period, again with a significantly higher average efficiency. Here the average efficiency of a fast start is 16 percentage points better than the normal start, with the consequent reduction in CO2 emissions. This increased average efficiency translates into an extra revenue of about h850 000 per year for a cycling plant, taking into account an average electricity revenue of h50/MWh and the additional fuel consumed.

An additional benefit from running up faster are the reduced CO2 emissions due to the higher average efficiency of the start-up and the reduced NOx emissions due to the faster transient through the low power region.

Putting a value on flexibility

Direct modelling of fast start-up benefits can be carried out based on a single plant net present value (NPV) analysis.

The following are the input assumptions for a 400 MW combined cycle power plant:

Load regime: 200 hot, 50 warm starts per year (expected starts 90-95%);

Fuel price: h4.9 per GJ;

Revenues for electricity production: 50%/75% of baseload during warm/hot start, h50 per MWh at baseload;

Costs for balancing energy: h75 per MWh;

Plant lifetime: 20 years;

Other variable costs: no difference between fast and normal start.

The operational duty is considered to be daily cycling, eg with overnight shut-down on weekdays and weekend shut-down. The majority of the starts (>90%) will be in accordance with long-term scheduling. The fuel price of h4.9/GJ is assumed as an average for a European location. As the majority of the starts are expected, a reduction of the electricity revenues to below the average baseload revenues of h50/MWh is assumed. For hot expected starts the revenue during the start is assumed to be 75% of the baseload revenue, for the warm expected start this is reduced to half of the baseload revenues.

The future revenue streams are discounted in the NPV calculation. All other variable costs are considered to be the same for the two different start-up modes.

Reductions in emissions are not considered here. So benefits from, for example, carbon dioxide certificate trading are not taken into account, giving a conservative approach to start-up time reduction evaluation.

The results of the economic evaluation are shown in Figure 5. With the assumptions listed above the evaluated benefit over the plant lifetime is around h100 000 per minute of start-up time reduction.

The evaluation factor (benefit of one minute reduction in start-up time) is strongly dependent on the assumed operational details and the specific market requirements. Figure 5, for example, shows the effect of different proportions of expected and unexpected starts.

The numbers are an indication of the value of flexibility. As they are highly dependent on the boundary conditions projects need to be assessed on a case by case basis.

Even with the conservative assumptions made, a start-up time reduction of 20 minutes, which can be achieved with available Siemens technology for fast cycling plants, will amount to savings of h2 million over the plant lifetime.

This evaluation arises from direct modelling of the benefits against an assumed constant market. For a limited set of input parameters and a manageable set of boundary conditions the direct evaluation gives clear and straightforward evaluation factors. However, considering more advanced market scenarios and operational regimes requires direct modelling against volatile input parameters. Here a dispatch model approach is better suited to accommodate the correlations between different factors or completely different plant behaviours.

As an example of the dispatch modelling approach we can compare two operational strategies for dealing with low electricity revenues at night: shut down vs continuing to operate at minimum load during the night.

In a dispatch model, market assumptions, eg the demand and the revenue curves, are either taken from history or are adapted curves for assumed future market behaviour. The different technical options or operational strategies are then modelled, with their capabilities, constraints and associated costs. The results provide comparisons between the different approaches in the assumed market environment.

In this case we assume: 20 years lifetime; 400 MW combined cycle plant in cycling mode; fuel price of h4.9/GJ; and electricity revenues of h50 /MWh during the day and h25/MWh during the night. The dispatch model shows that shut down at night and restart in the morning has a positive net present value over the plant lifetime of h18.6 million for the operator compared with continuing to operate at minimum load during the night.

The additional start-up cost is far lower than the unfavourable revenue stream at minimum load during the night. This decreases the marginal cost of power production and increases the dispatch rank of the plant.

How fast can start-ups be?

So what start-up times have been achieved in the field with a Siemens combined cycle power plant? Figure 6 shows the results of a plant test on a single shaft site with a conventional drum HRSG. The plant was ramped up fully automatically according to the new fast start procedure.

For the start-up time optimisation, a holistic approach was taken, involving not just the gas turbine and HRSG but all aspects of plant design. With all parties working together further potential was identified with a revised unit start-up procedure for hot starts (about 8 h downtime). The interaction of the gas turbine, steam turbine and BoP was optimised. The result is the so-called parallel start-up procedure where the gas turbine is started and ramped up at the maximum allowable gradient. The exhaust gas is led through the HRSG and the first steam is directly used for steam turbine roll off. There is early closing of the HP/IP bypass valves.

The new concept is not only applicable to new plants but is also available as an upgrade package for plants in operation. After analysing and assessing the existing plant design and equipment, we can define fast start-up features which could be implemented without any disadvantages in terms of plant performance and lifetime.

Some fast-start-up features have already been implemented at plants in Spain and Portugal and have been proven during commissioning and commercial operation.

Adoption of the fast-start procedures outlined here enables these types of combined cycle power units to be the fastest starting plants in their class.

To reduce the lifetime impact of fast cycling on a conventional drum HRSG, we have designed, tested and implemented (at Cottam in the UK) a horizontal-exhaust-flow once-through low-mass-flux vertical-tube Benson HRSG, which is licensed to the major HRSG suppliers. This eliminates drums, but entails additional condensate polishing plant. A number of additional combined cycle plants with this type of Benson HRSG are currently under construction or planned.

How to improve your economics

To summarise:

• Changing markets require power plants to be more flexible. Fast start-up and cycling flexibility are essential features to ensure economic success in a liberalised market.

• Fast start-up provides additional benefits to the power plant owner, eg, reductions in fuel costs and emissions, together with increased market compliance advantage.

• Combined cycle fast cycling capabilities have been tested and verified in real applications.

Several owners have now specified the Siemens advanced fast cycling package of features (called Advanced FACY) for new plants and it is being offered as an upgrade for existing plants.

Figure 1. Variable production cost, dispatch rank and projected dispatch rate Figure 2. Typical areas of application for the various power plant types and their requirements (German market) Figure 3. Design features for fast cycling (combined cycle plant with, conventional, drum HRSG) Figure 4. Faster start-up has significant benefits, whether the start is expected or unexpected Figure 5. Calculated benefits of reduction in start-up time, plotted against proportion of expected starts (as percentage of total (expected plus unexpected) starts Figure 6. Comparison, or hot start conditions, of advanced ‘fast cycle’ start-up time with normal start-up time (Siemens SCC5-4000F 1S combined cycle plant). A time of less than 40 minutes was achieved in a fully automated plant test. Fast and reliabl